The First Income Tax

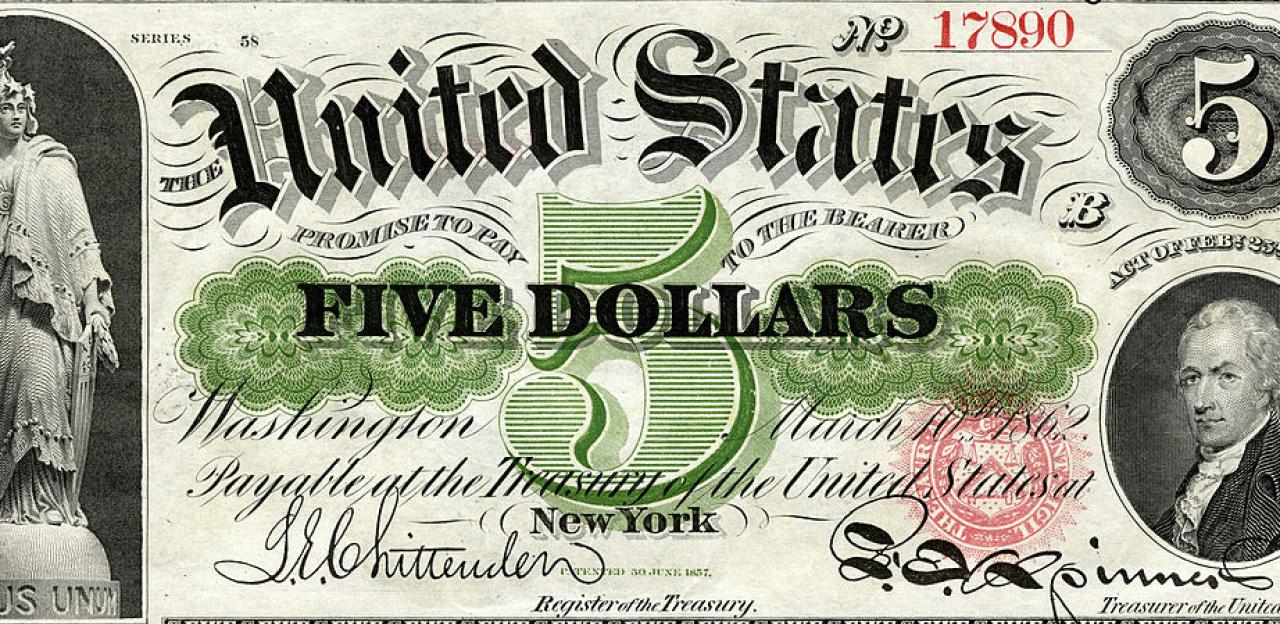

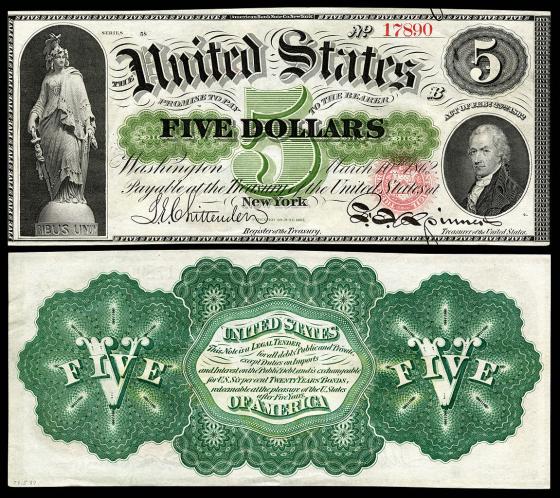

The first Federal income tax was levied to help pay for the Union war effort. In the summer of 1861, Salmon P. Chase reported to the Congress that he would need $320 million over the next fiscal year to finance the war. He thought he could put his hands on $300 million by borrowing part of it and raising the rest through existing taxes and sale of public lands. He left it up to Congress to come up with a way to raise the remaining $20 million.

After weighing their options, the House Ways and Means Committee drew up a bill to tax personal and corporate incomes. This bill, the first income tax measure in the United States, called for a 3% tax on incomes over $800. Although the bill quickly passed in both the House and the Senate, it was never put into operation. Still, it paved the way for the next bill of its kind.

In 1862, Abraham Lincoln signed a bill that imposed a 3% tax on incomes between $600 and $10,000 and a 5% tax on higher incomes. The law was amended in 1864 to levy a tax of 5% on incomes between $600 and $5,000, a 7.5% tax on incomes in the $5,000-$10,000 range and a 10% tax on everything higher. The law was repealed in 1872 and declared to be unconstitutional.

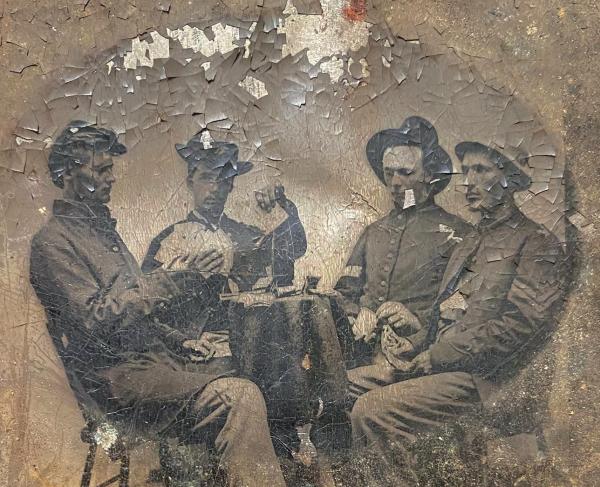

The Confederacy also collected income taxes. It authorized its first national income tax measure in 1863. The Confederate bill that finally passed after great debate was a graduated income tax. It exempted wages up to $1,000, levied a 1% tax on the first $1,500 over the exemption, and 2% on all additional income.

Learn More: Military Pay